The 'CardSaver' Platform Can Handle Unlimited Credit Cards

Michael Hemsworth — May 26, 2022 — Tech

References: cardsaver.app & betalist

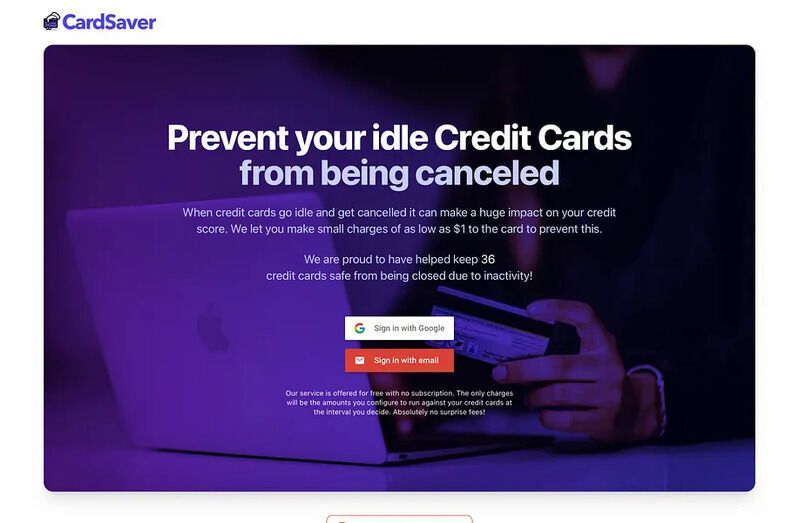

Having credit cards that go unused for months at a time can quickly develop into the account being closed, which is something the 'CardSaver' platform can help with. The platform works by having an unlimited number of credit cards added where they will keep the account active on a continuous basis by performing small charges. The card information is utilized via Stripe with no information pertaining to the cards stored on the platform's server.

The 'CardSaver' platform offers flexible options for utilizing the account with amounts as low as $1 and intervals ranging from everyday to once a year. The platform could help accounts from being closed without the authorization of the card holder, which could affect their credit score as a result.

The 'CardSaver' platform offers flexible options for utilizing the account with amounts as low as $1 and intervals ranging from everyday to once a year. The platform could help accounts from being closed without the authorization of the card holder, which could affect their credit score as a result.

Trend Themes

1. Credit-card Maintenance Revolution - CardSaver has set a precedent for tech platforms that maintain one's credit standing, and this can inspire more platforms built around this same concept.

2. Unlimited Credit Cards Management - CardSaver has created a new method for managing unlimited credit cards, where other companies can piggyback on and create new innovative products that can leverage this concept.

3. Flexible Payment Scheduling - CardSaver's payment model has the potential to inspire other financial services to offer more flexible payment scheduling options.

Industry Implications

1. Financial Technology - CardSaver is a great example that can inspire other fintech startups to build on that same concept, digitizing more financial services and democratizing access to financial management tools and services.

2. Credit Card Companies - Existing credit card companies could adopt CardSaver's approach and create new products that leverage the concept of continuously using dormant cards for credit score management.

3. Consumer Credit Management - CardSaver's platform could open up opportunities in credit management for low-credit consumers, providing them more tools and flexibility around credit score management.

1.1

Score

Popularity

Activity

Freshness