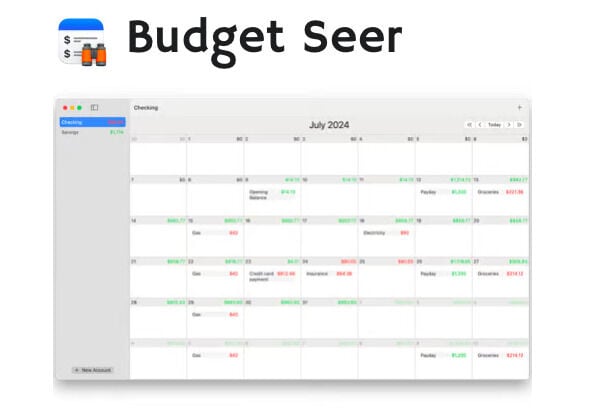

Budget Seer Provides Real-Time Daily Insights Into Your Financial Health

Ellen Smith — January 14, 2025 — Business

References: caseirosoftware

Budget Seer offers a proactive approach to personal finance management by providing daily insights into account balances and spending limits. Unlike traditional budgeting tools that focus on monthly overviews, Budget Seer empowers users to track their financial health on a day-to-day basis.

This granular view helps individuals determine how much they can spend daily without compromising future goals or stability. By visualizing available funds in real time, Budget Seer supports smarter financial decisions and reduces the likelihood of overspending. It’s designed for those who want to take control of their finances with ease, offering clarity and confidence in managing both short-term expenses and long-term plans. The platform’s focus on daily budgeting ensures a practical and disciplined approach to maintaining financial well-being.

Image Credit: Budget Seer

This granular view helps individuals determine how much they can spend daily without compromising future goals or stability. By visualizing available funds in real time, Budget Seer supports smarter financial decisions and reduces the likelihood of overspending. It’s designed for those who want to take control of their finances with ease, offering clarity and confidence in managing both short-term expenses and long-term plans. The platform’s focus on daily budgeting ensures a practical and disciplined approach to maintaining financial well-being.

Image Credit: Budget Seer

Trend Themes

1. Real-time Financial Insights - The ability to access up-to-the-minute data on spending and balances provides a proactive method for managing personal finances.

2. Daily Budgeting Techniques - Focusing on day-to-day spending instills disciplined financial habits and prevents overspending through immediate feedback.

3. Granular Financial Management - Breaking down finances into detailed daily views allows individuals to better align their spending with both short-term and long-term financial goals.

Industry Implications

1. Fintech Platforms - The integration of tools that offer real-time financial tracking can revolutionize how users engage with personal finance management.

2. Personal Finance Apps - Applications that provide daily insights into financial health are reshaping how consumers interact with their money.

3. Digital Financial Advisory - The shift to detailed, daily financial data presents new opportunities for advisory services to provide personalized, actionable insights.

3.6

Score

Popularity

Activity

Freshness