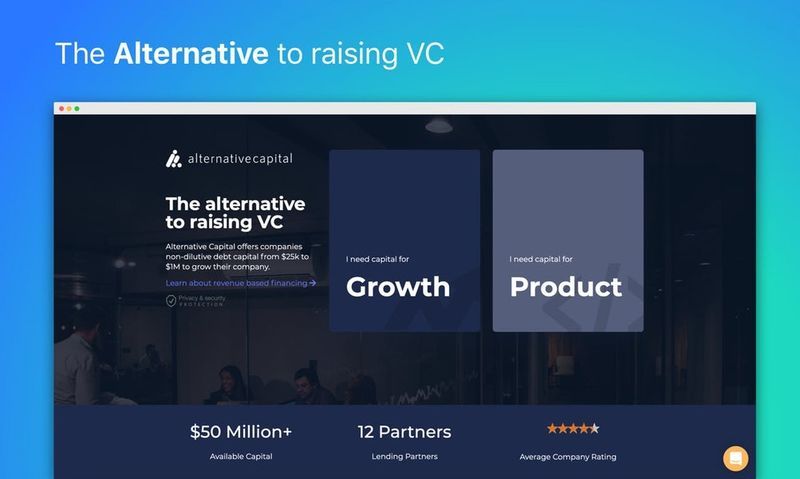

'Alternative Capital' Provides Non-Dilutive Debt Capital

Michael Hemsworth — June 12, 2019 — Tech

References: alternativecapital.io & betalist

Venture capital (VC) funding is the traditional route for startups to take when seeking funds to support growth, but 'Alternative Capital' is positioned as another option for businesses to help them get off the ground.

The company will provide non-dilutive debt capital ranging from $25,000 all the way up to one million to help businesses accelerate their growth instead of relying on VCs. The lending protocol will enable startups to feel less weary about the money they receive and keep the ownership that they might otherwise be required to provide to VCs providing funds.

'Alternative Capital' utilizes a revenue-based lending system, and works by having startups apply, interview and receive funding after being approved by the company.

The company will provide non-dilutive debt capital ranging from $25,000 all the way up to one million to help businesses accelerate their growth instead of relying on VCs. The lending protocol will enable startups to feel less weary about the money they receive and keep the ownership that they might otherwise be required to provide to VCs providing funds.

'Alternative Capital' utilizes a revenue-based lending system, and works by having startups apply, interview and receive funding after being approved by the company.

Trend Themes

1. Non-dilutive Funding - Exploring alternative ways for startups to secure capital without giving up ownership.

2. Revenue-based Lending - Using a lending system that ties repayment to a company's revenue to provide more flexible funding options.

3. Startup Acceleration - Supporting the growth of start-ups through funding solutions that enable them to scale faster.

Industry Implications

1. Fintech - Utilizing technology to disrupt traditional venture capital funding by providing alternative funding options for startups.

2. Startups - Empowering early-stage businesses by offering non-dilutive debt capital to support their growth.

3. Entrepreneurship - Promoting innovation and entrepreneurship by providing financing solutions that reduce reliance on venture capital funding.

1.6

Score

Popularity

Activity

Freshness