Ushur Improves Short-Term Disability Absence Processes

References: globenewswire

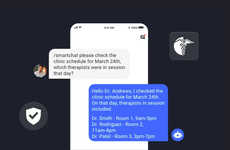

Ushur has introduced an AI-powered self-service platform designed to improve the short-term disability absence process for insurance carriers. By automating critical communications and information sharing, this solution aims to address inefficiencies caused by manual data collection and follow-ups that often delay claims and frustrate employees. The AI-powered self-service platform allows carriers to guide claimants through each stage of the short-term disability journey, gather necessary data, and reduce manual intervention.

Key features in Ushur's solution include proactive communication with employees and employers, secure handling of sensitive information through HIPAA-compliant channels, and automated claim processing steps, such as collecting e-signatures and authorizations. It also offers real-time updates to both parties on the claim's progress. This approach improves the customer experience while also reducing the burden on staff and boosting operational efficiency.

With real-world examples showing a significant reduction in processing time and increased customer satisfaction scores, the solution is positioned as a practical way to modernize and streamline the short-term disability absence management process.

Image Credit: Ushur

Key features in Ushur's solution include proactive communication with employees and employers, secure handling of sensitive information through HIPAA-compliant channels, and automated claim processing steps, such as collecting e-signatures and authorizations. It also offers real-time updates to both parties on the claim's progress. This approach improves the customer experience while also reducing the burden on staff and boosting operational efficiency.

With real-world examples showing a significant reduction in processing time and increased customer satisfaction scores, the solution is positioned as a practical way to modernize and streamline the short-term disability absence management process.

Image Credit: Ushur

Trend Themes

1. AI-driven Claims Automation - Automation of claim processing steps, including e-signature and authorization collection, minimizes errors and speeds up the overall process.

2. Proactive Communication Solutions - Utilizing proactive communication methods enhances customer engagement and ensures that both employees and employers stay informed in real-time.

3. Secure Digital Data Handling - Ensuring sensitive information is managed through HIPAA-compliant channels builds trust and enhances data security in insurance transactions.

Industry Implications

1. Insurance Technology - Innovations in insurance tech, particularly AI-driven platforms, significantly streamline operational processes and improve customer experiences.

2. Healthcare Information Security - Advancements in secure handling protocols for sensitive data address growing concerns over privacy and compliance in the healthcare sector.

3. Employee Benefits Management - Enhanced platforms for managing short-term disability absences facilitate better service delivery and satisfaction among employees.

4.1

Score

Popularity

Activity

Freshness