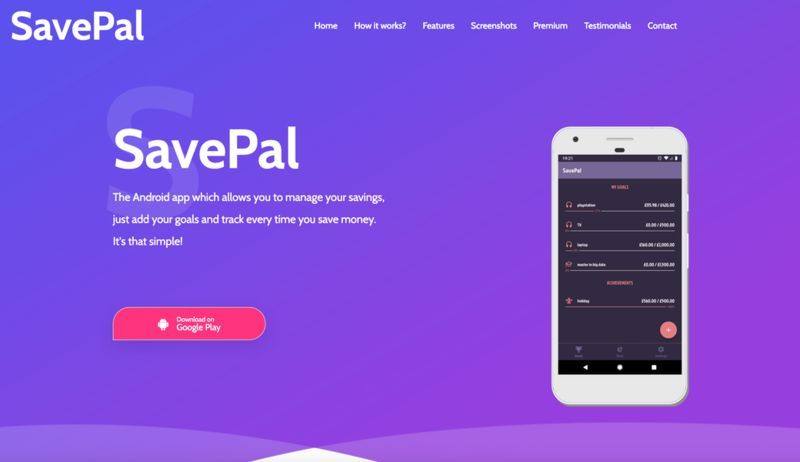

The 'SavePal' App Keeps Users Motivated to Save for Specific Goals

Michael Hemsworth — March 30, 2019 — Lifestyle

References: savepal.es & betalist

Savings accounts have been the mainstay way to put money away for a certain purchase or goal, but the 'SavePal' app aims to bring about a more personalized experience to keep individuals focused on the end goal.

The app works by reinforcing the savings process and helping users to pinpoint where additional savings can be made each month by canceling subscriptions, curb bad spending habits and more. Users can easily see the history of their saving achievements to keep an eye on the larger picture and also see how they have financially improved (or not) over the course of an extended period.

The 'SavePal' app comes as one of a growing number of financial improvement solutions as consumers seek to take more control over their money and savings.

The app works by reinforcing the savings process and helping users to pinpoint where additional savings can be made each month by canceling subscriptions, curb bad spending habits and more. Users can easily see the history of their saving achievements to keep an eye on the larger picture and also see how they have financially improved (or not) over the course of an extended period.

The 'SavePal' app comes as one of a growing number of financial improvement solutions as consumers seek to take more control over their money and savings.

Trend Themes

1. Personalized Financial Solutions - Developing customized, user-centered financial solutions that help individuals to meet their specific saving goals and needs.

2. Behavioral Economics Applications - Applying principles of behavioral economics to help individuals build and maintain good financial habits, such as reducing expenses, avoiding debt and saving more.

3. Gamification Techniques - Using gamification techniques and incentives to make financial goal-setting and savings more engaging and fun.

Industry Implications

1. Personal Finance - Creating innovative financial technology solutions, such as apps, platforms and services, to help consumers manage their finances and meet their savings goals.

2. Consumer Technology - Incorporating smart technologies, such as AI, data analytics and biometrics, to build more intelligent, secure and user-friendly financial management tools and apps.

3. Retail Banking - Integrating financial planning and saving features into retail banking products and services, such as checking accounts, credit cards and loans, to create more value for customers and build loyalty.

1.6

Score

Popularity

Activity

Freshness