Yahoo Finance, EquityZen & Forge Global Debut Private Markets Hub

Yahoo Finance has introduced an innovative private markets hub through partnerships with EquityZen and Forge Global. This move is said to mark a significant advancement in financial data accessibility.

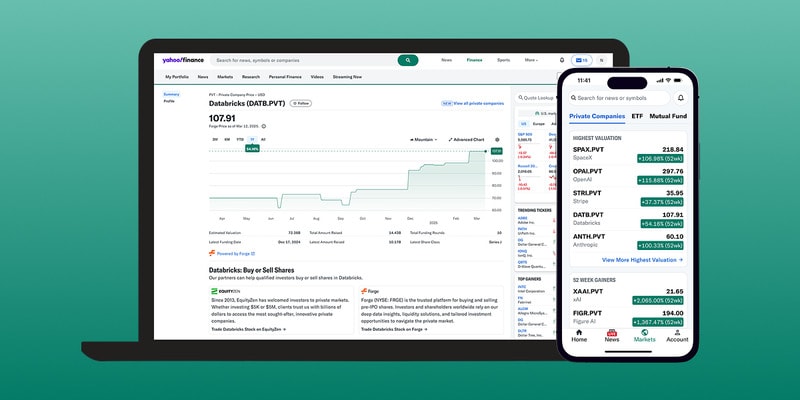

Yahoo Finance's new private markets hub feature provides real-time pricing, valuation metrics, and comparative analysis for late-stage private companies. This type of information was previously fragmented or exclusive to institutional investors. By integrating private market indices, benchmarks, and transaction capabilities directly into its platform, Yahoo Finance bridges the gap between public and private equity markets. Users can now track unicorns and growth-stage startups alongside public stocks within unified portfolios, while accredited investors gain seamless access to transact pre-IPO shares through linked partner platforms.

The initiative addresses a critical market need as companies delay IPOs longer than ever — nearly 11 years on average — leaving retail investors historically underserved during a company’s high-growth private phase.

Image Credit: Yahoo Finance

Yahoo Finance's new private markets hub feature provides real-time pricing, valuation metrics, and comparative analysis for late-stage private companies. This type of information was previously fragmented or exclusive to institutional investors. By integrating private market indices, benchmarks, and transaction capabilities directly into its platform, Yahoo Finance bridges the gap between public and private equity markets. Users can now track unicorns and growth-stage startups alongside public stocks within unified portfolios, while accredited investors gain seamless access to transact pre-IPO shares through linked partner platforms.

The initiative addresses a critical market need as companies delay IPOs longer than ever — nearly 11 years on average — leaving retail investors historically underserved during a company’s high-growth private phase.

Image Credit: Yahoo Finance

Trend Themes

1. Increased Financial Data Accessibility - Widespread access to private company financial data dissolves barriers historically limiting retail investors to public markets.

2. Integration of Public and Private Markets - Converging public and private equity markets on a unified platform transforms investment strategies and expands portfolio tracking capabilities.

3. Delayed IPO Trend - Prolonged IPO timelines highlight the demand for platforms that allow retail investors to participate in high-growth phases of private companies.

4. Real-time Private Valuations - Providing real-time pricing and valuations for private companies can shift decision-making processes for investors seeking diverse portfolio compositions.

Industry Implications

1. Fintech - Innovations in financial technology are democratizing investment opportunities by simplifying access to previously exclusive market data.

2. Investment Platforms - Emerging platforms that facilitate pre-IPO share transactions are redefining the landscape for retail investment in growth-stage companies.

3. Private Equity - The bridging of public and private equities creates new opportunities for private equity firms to attract a broader range of investors.

6.3

Score

Popularity

Activity

Freshness