Tribe Money Pools is Introducing an Innovative Payment App

References: tribe.money & globenewswire

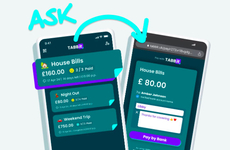

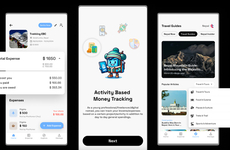

Tribe Money Pools' innovative payment app is designed to simplify the management of group finances. Unlike traditional financial apps that focus on individual transactions, Tribe Money Pools is tailored for collective financial management and promises to allow groups such as families, roommates, student organizations, and even small businesses to pool and manage their funds for shared expenses.

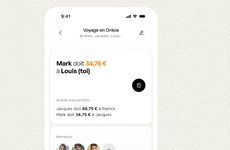

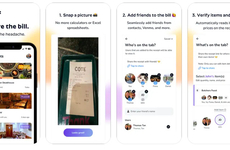

Tribe Money Pools' innovative payment app enables users to create a group, where they can invite members to contribute to a shared account. The company also offers features like transparent fund management, secure transactions with bank-grade security, and a streamlined process for requesting and receiving funds.

The app also boasts a user-friendly design that may attract individuals looking for a more intuitive way to collaborate on money management without relying on cumbersome spreadsheets or informal payment systems.

Image Credit: Tribe Money Pools

Tribe Money Pools' innovative payment app enables users to create a group, where they can invite members to contribute to a shared account. The company also offers features like transparent fund management, secure transactions with bank-grade security, and a streamlined process for requesting and receiving funds.

The app also boasts a user-friendly design that may attract individuals looking for a more intuitive way to collaborate on money management without relying on cumbersome spreadsheets or informal payment systems.

Image Credit: Tribe Money Pools

Trend Themes

1. Collaborative Fintech Solutions - Emerging fintech solutions are emphasizing collaboration, transforming individual-centric financial models to prioritize shared expenses for groups.

2. User-friendly Financial Platforms - Financial platforms are increasingly focusing on user-friendly interfaces, minimizing complexities and enhancing the adoption rate among non-tech-savvy groups.

3. Secure Group Transactions - The focus on bank-grade security for group transaction apps is revolutionizing how shared financial activities are managed without compromising safety.

Industry Implications

1. Peer-to-peer Payment Systems - This industry is evolving by integrating group-focused features, challenging traditional one-to-one transaction methods.

2. Digital Banking - Digital banking is expanding its scope by incorporating collective finance management, addressing the needs of collaborative economies.

3. Software as a Service (saas) - SaaS models are increasingly incorporating financial tools for group use, redefining subscription services with shared access capabilities.

4.8

Score

Popularity

Activity

Freshness