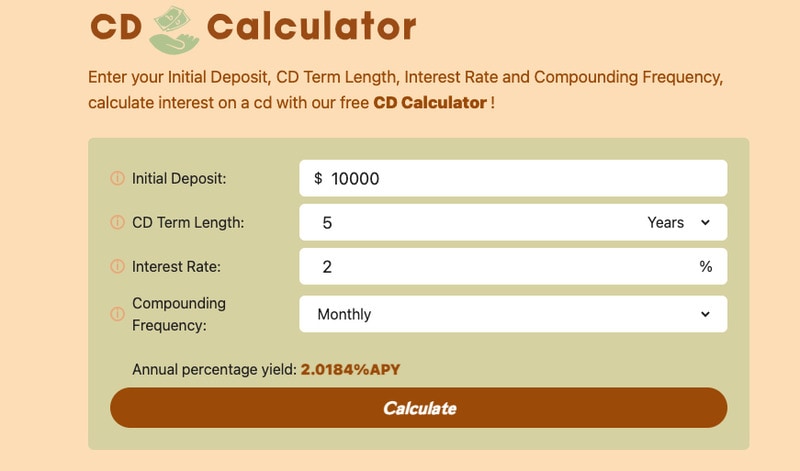

CD Calculator Helps You Estimate Interest Earnings With Ease

Ellen Smith — April 13, 2025 — Business

References: cdcalculator.cc

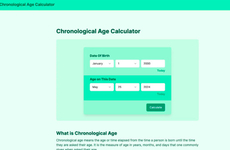

The CD Calculator is a straightforward financial planning tool designed to help users estimate potential earnings from Certificates of Deposit (CDs). By inputting key variables such as initial deposit, term length, annual interest rate, and compounding frequency, users can quickly calculate projected interest and total returns.

This tool provides a clear picture of how savings may grow over time, supporting informed financial decision-making. It is especially useful for individuals comparing investment options or evaluating short- to mid-term savings strategies. With increasing interest in low-risk, fixed-return products, a CD calculator can simplify the evaluation process by offering transparent, immediate results. Its free and accessible format makes it practical for consumers, advisors, or financial educators aiming to demonstrate the impact of interest compounding on long-term savings outcomes.

Image Credit: CD Calculator

This tool provides a clear picture of how savings may grow over time, supporting informed financial decision-making. It is especially useful for individuals comparing investment options or evaluating short- to mid-term savings strategies. With increasing interest in low-risk, fixed-return products, a CD calculator can simplify the evaluation process by offering transparent, immediate results. Its free and accessible format makes it practical for consumers, advisors, or financial educators aiming to demonstrate the impact of interest compounding on long-term savings outcomes.

Image Credit: CD Calculator

Trend Themes

1. Financial Planning Simplification - Digital tools like the CD Calculator are transforming how individuals approach personal finance by simplifying complex processes into accessible formats.

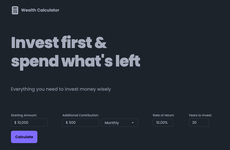

2. Rise of Fixed-return Products - Growing interest in low-risk, fixed-return investment products is steadily reshaping consumer investment strategies and financial planning.

3. Empowerment Through Financial Literacy - Enhanced accessibility to financial calculators fosters increased financial literacy, encouraging more informed and confident user-driven decision-making.

Industry Implications

1. Personal Finance Technology - Innovations in personal finance technology are enabling users to make more informed decisions with tools that provide transparency and ease of use.

2. Investment Advisory Services - The rise of digital financial calculators is reshaping investment advisory by equipping advisors with quick, precise tools for client engagements.

3. Education and Financial Literacy - Tools that demonstrate the effects of compound interest have significant potential within the educational sector, promoting foundational financial understanding.

4.3

Score

Popularity

Activity

Freshness